What is a MIC?

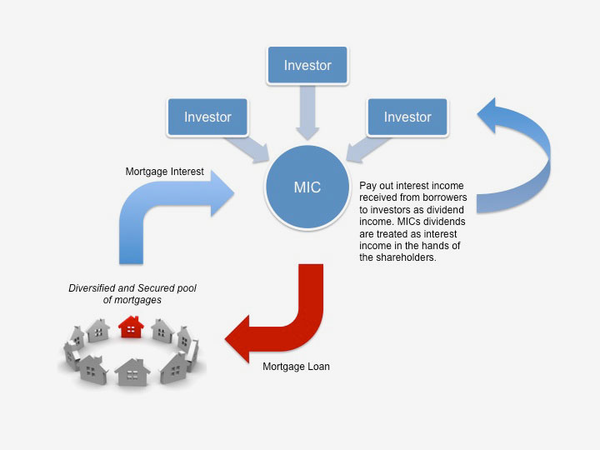

A mortgage investment corporation (MIC) is a type of company in Canada that pools money from investors to lend out mortgages to borrowers.

What's a MIC?

A Mortgage Investment Corporation or MIC is an investment and lending company designed specifically for mortgage lending in Canada. Governed by Section 130.1 of the Income Tax Act, MICs pay no corporate tax and act as flow-through entities and have to pay out all their taxable income in the form of dividends. For tax purposes, MICs dividends are treated as interest income in the hands of the shareholders.Portfolio

Types of asset

MIC’s portfolio can include everything from first mortgages on single-family homes to construction loans on commercial development projects.

Secured by real estate

The mortgages are secured on real property, often in conjunction with other forms of security, such as personal and corporate guarantees, general security agreements and assignments of rent, etc.

Alternative lenders

MICs fall under the category of alternative lenders (also called non-bank lenders).